We face a new challenge to our ability to effectively advocate for the 180,000 children in our public schools – the prohibition of payroll dues deduction.

The bill, sponsored by Representatives, Hinch, Kurk, Packard, Chandler, Carr and Ohm states that “no public employer shall withhold union dues from a public employee’s wages. No other deductions are targeted by their bill. Only union dues.

This legislation serves no purpose except to punish school employees and the unions that represent them. It creates no jobs, saves no money for school districts, and does nothing to improve education. It is a mean-spirited political attack by majority leadership and a clear infringement of personal liberty of law-abiding citizens of the Granite State.

New Hampshire law clearly protects authorized paycheck deduction of payment to labor unions and for a broad range of other allowable purposes that benefit private entities. In fact, current law allows deductions for any lawful purpose that an employer and employee mutually agree on. Disallowing dues deductions for public employees denies us basic democratic freedoms and the same protection under the law that every other employee in the state enjoys.

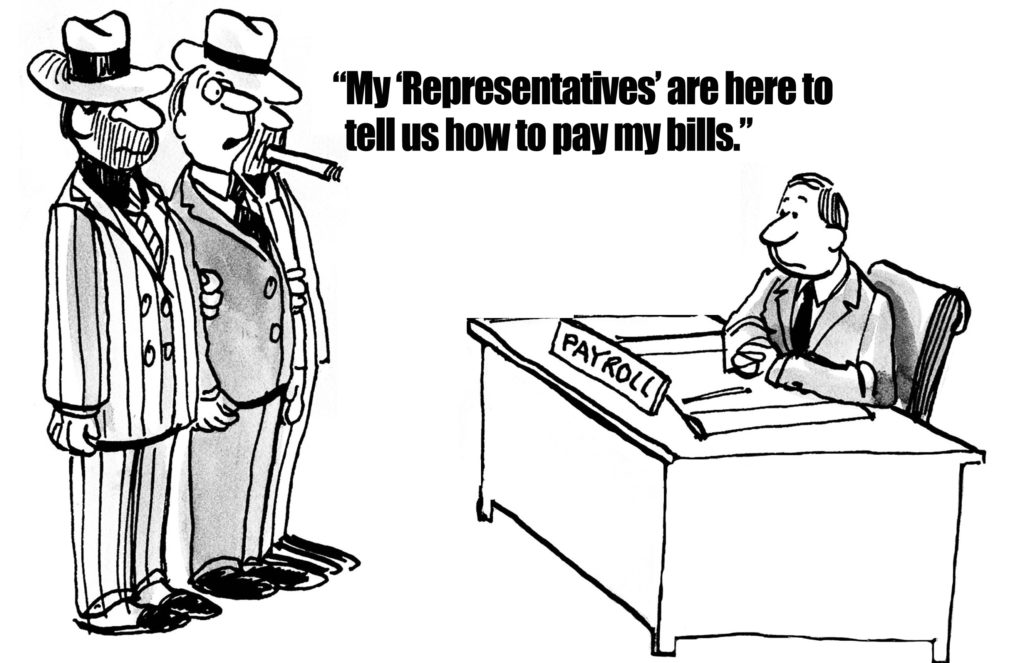

“Once the funds are in my paycheck, shouldn’t I be the only one who gets to decide what to do with the money I have earned?,” stated Tuttle. As long as I’m using my earnings for legal purposes, why do Representative Kurk and the others get to tell me what I can or cannot do with my own pay? Does working for a public school system make me a second-class citizen?”

It’s never been easier to Take Action: Use Our Online Take Action Center and Talking Points to Contact Your Representatives and Tell Them to Defeat HB 438.

Background:

Voluntary deduction of union dues or other payments for lawful purposes from an employee’s wages is regulated by NH RSA 275:48 (“Payment of Wages”). The statue allows paycheck deductions “for any purpose on which the employer and employee mutually agree that does not grant financial advantage to the employer, when the employee has given his or her written authorization and deductions are dully recorded.”

Since 2000, the general legislative trend for regulating paycheck deductions in New Hampshire has been to clarify and expand the purposes for which paycheck deductions may be allowed.

Legislative attempts to restrict paycheck deductions of union dues have been previously introduced but failed to pass including attempts in 2002 and 2012.

Take Action:

Taking action has never been easier for our members. Click on Legislative Action, then on Take Action. From there you’ll be able to make calls, write messages, and sign petitions to let your Representatives know you do not need them sitting next to you as you pay your bills.

We’ve also provided some tested and effective talking points you can use to help craft your messages.

Talking Points:

- This bill is government intrusion, pure and simple. It’s an attack on employees’ democratic freedoms and constitutional rights that every New Hampshire legislator should oppose.

- Paycheck deduction is a longstanding tradition allowed by New Hampshire law. NH law allows an employee to give written permission to his or her employer to voluntarily deduct union dues from their paycheck – along with other recurring expenses such as health, welfare, pension fund contributions, housing and utilities, and contributions to charities.

- Paycheck deductions aren’t forced on employees or employers – it’s always negotiated between the two parties. Currently, school districts and local associations have the freedom to negotiate contracts allowing members to make dues payments through automatic payroll deductions. Eliminating this option is a clear infringement on local control.

- The bill creates no new rights or freedoms for union members to control their paychecks. Union members already have numerous rights regarding how their money is spent, whether or not to join a union, the election of their own leaders and the setting of dues amounts.

- No one has payroll dues deduction unless they choose it. Members provide written authorization allowing the automatic deductions to take place. So automatic payroll deductions can’t take place until members take at least two affirmative steps: first, collectively negotiate the right to use deductions, and second, individually authorize them.

- The bill will not save school districts money. Payroll deductions for union dues impose no costs on public school districts beyond the costs the payroll system already creates in allowing school employees to use payroll deductions to pay taxes and make contributions to health insurance, pension plans, and charitable organizations.

- The bill unfairly singles out public sector union members. Payroll deductions from insurance companies, charities and credit unions will continue to be allowed. The bill discriminates against union members and their employers who have freely chosen to use payroll deduction to pay voluntary membership dues to organizations they have freely chosen to join.

- This legislation serves no purpose except to punish school employees and the unions that represent them. It creates no jobs, saves no money for school districts, and does nothing to improve education. It is a political attack by majority leadership and a clear infringement of personal liberty of law-abiding citizens of the Granite State.