A Great Public School for Every Student

We are New Hampshire's largest educator union; together our voice is stronger as we advocate for our students, our schools, our communities, and our profession.

Get the Latest on

03/07/26: NEA-NH Legislative Update - Attack on Collective Bargaining, Budget Caps, and Voucher Expansion Up for Votes This Week

03/07/26: NEA-NH Legislative Update - Attack on Collective Bargaining, Budget Caps, and Voucher Expansion Up for Votes This Week

This will be a huge week for the New Hampshire House with over 180 bills on the regular calendar that will be voted on. On Wednesday and Thursday, the House will meet for what is anticipated to be two long days of voting on highly consequential bills, including an attack on collective bargaining rights and another school budget cap bill.

2026 NEA-NH Guide to Annual School District Meetings

2026 NEA-NH Guide to Annual School District Meetings

Across New Hampshire, communities hold annual school district meetings in March during which voters have the opportunity to weigh in on matters facing their local public school, including budgets and educator contracts.

PRESS RELEASE: Ayotte Address Applauds Educators, Avoids Big Issue Facing Public Schools

PRESS RELEASE: Ayotte Address Applauds Educators, Avoids Big Issue Facing Public Schools

NEA-NH President Megan Tuttle released a statement following Governor Kelly Ayotte's State of the State address.

How NEA–NH Membership Helped Amherst Educators Reach a Fair Agreement

How NEA–NH Membership Helped Amherst Educators Reach a Fair Agreement

Stable schools depend on stable educators. When teachers have a fair contract, their focus can remain where it belongs—on students, collaboration, and working to implement district goals. Here's the story of how Amherst educators reached a fair agreement.

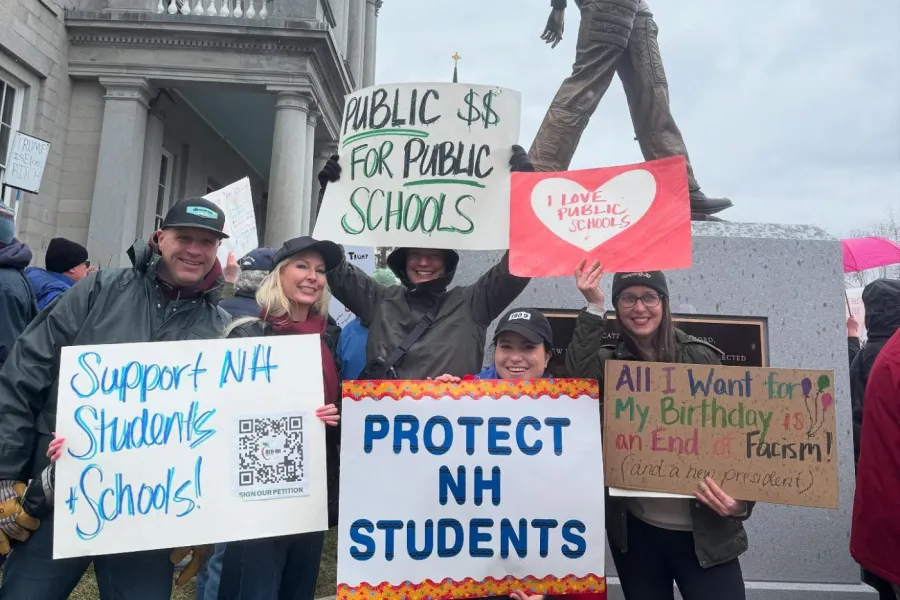

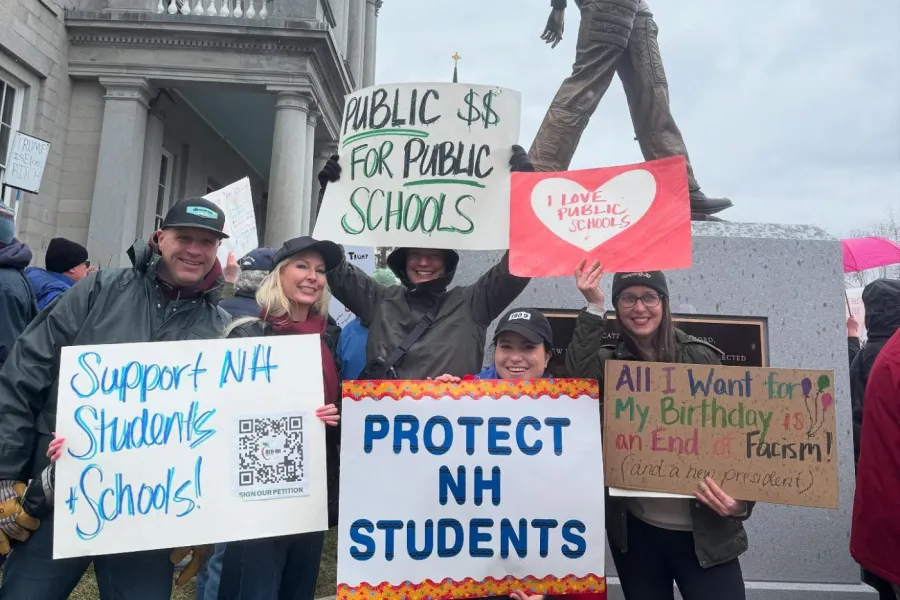

New data shows New Hampshire 50th in the nation for state public education funding; some gains in educator pay, but profession is still undervalued and underpaid

New data shows New Hampshire 50th in the nation for state public education funding; some gains in educator pay, but profession is still undervalued and underpaid

National Education Association releases four reports detailing the state of education funding and pay for educators in New Hampshire and around the country

Our best hope for student success IS YOU.

Your passion and commitment are crucial to helping all students—of all colors and backgrounds—learn, grow, and fulfill their potential. Here’s how you can get started.

Achieve professional excellence

Advocate for Your Rights & Working Conditions

Advance justice with us

Your Union. Your Voice.

We are THE voice for educators in New Hampshire. Learn more and get involved with your union!

Let’s BRING REAL CHANGE

Let’s GET REAL

1 in 5 children lack consistent access to meals at home.

Let’s BRING REAL CHANGE

The Community Eligibility Provision of the Healthy, Hunger-Free Kids Act eliminates student hunger at school. Some politicians want to end it, but we can build a future where every child is fed, focused, and free to learn.

Learn what's at stake for students & communities

38 million children receive health care coverage through Medicaid and the Children’s Health Insurance Program

Let’s BRING REAL CHANGE

Congress is considering cuts to Medicaid that threaten the healthcare that tens of millions of families rely on to cut taxes for the wealthy, but educators are speaking out about the importance of Medicaid funding to our families, schools, and communities.

Learn more about how educators are speaking out

What’s on Your Mind?

We’re here to help. Our union has the tools we need (guides, reports, trainings, and more) to help answer everyday questions. Together, we can support each other in whatever we need.

- Collective Bargaining

- College Affordability

- Diversity & Inclusion

- Education Funding

- Gun Violence

- High Poverty Schools

- Immigration

- Legislation

- Mental Health

- Multi-Lingual Learners

- Politics & Campaigns

- Privatization

- Racial & Social Justice

- School Climate

- Special Education

- Trauma

- Voting Rights

- Workplace Conditions

"Students with disabilities weren't educated in most cases."

In 1975, Congress passed what is now known as the Individuals with Disabilities Education Act (IDEA), requiring schools to provide equal access to education for all students with disabilities. The landmark law ushered in an era of inclusion and equity. The current assault on public schools could unravel that progress, leaving students without the support they need.

A society made stronger through world class public education

NEA-NH believes every student, regardless of family income or place of residence, deserves a quality education. In pursuing our mission, we will focus the energy and resources of our 17,000 members on improving the quality of teaching, increasing student achievement and making schools safer, better places to learn.